JackYi

14:21

身在行业中为什么总是忍不住看多,和过去创业经历有关,当年确实找不到工作开始创业,挣到第一桶金后,也不敢大消费而去投资科技项目,应该成绩还不错。15年进入币圈挖BTC,买ETH,投资项目,赶上了那个黄金年代,这是不断一路做多的收获。但后来的熊市投资大亏损➕熬不住熊市提前清仓BTC,最后错过了312后的大牛市,这是属于看空的后果。我们经历了2轮熊市后的牛市,所以这次在逃顶后,比较自信抄底过早,在控制风险情况下继续等待。

_gabrielShapir0

09:34

look deeper, it is easy to see "scams/bullshit" but underneath nearly every major success story in crypto, is a decrease in trust requirements and an increase in social scalability:

even https://t.co/hc9RflBXUY, considered by many to be frivolous etc., was a huge success because it completely standardized the memecoin launch process through the bonding curve 'graduation' and liquidity-locking mechanism. . .essentially each memecoin creator enters into an unbreachable agreement, which requires less trust and enables more social scale

these features derive from the 'hardness' property of blockchain systems...it is really the only area where blockchains excel...what's unleashed by the ensuing gains in social scaling may look like just rampant degen speculation at times, but it happens onchain because of the trust reduction, non-intermediation and ensuing increase to social scalability

you must evaluate different crypto projects on whether they are net-adding or net-reducing trust requirements/counterparty risks...this is the single best anti-fraud diligence item in crypto, as if it is adding more trust requirements or keeping trust requirements the same, there is likely no reason to put that onchain. . .

sources:

https://t.co/YXgb58TSWN

https://t.co/glWk94PlMB

大宇

02-04 13:09

AI泡沫崩盘的第一个信号出现了

AI的高潮是

1、英伟达承诺投资OPENAI 1000亿美元

2、OPENAI 承诺向甲骨文买算力

3、甲骨文向英伟达买显卡,大大扩建数据中心,然后卖算给OPENAI

现在英伟达老黄说:谁说了我TMD一定投的,是他邀请我们投,我投不投还没想好呢?

于是那边OPENAI说:我们不如自己搞芯片。

甲骨文:啥玩意?我搞了这么多钱买卡建数据中心,你们两个玩什么呢?完了,我先裁员吧,要崩盘了。

为啥老黄变脸?因为老黄能看到CHATGPT的订阅越来越慢,每年亏损50亿美元,卖显卡赚的钱不能这么花出去了——这是明智的,在牛市的时候我们赚钱也很快,但乱花出去的投资款基本上都回不来。

现在甲骨文的股票已经先崩为敬,他花500亿美元建数据中心,如果OPENAI没钱了,那他就找不到客户,这个数据中心就变废品了。

所以,硅谷这个左手倒右手的游戏遇到了第一个“黄天鹅”。

AI当然伟大,但泡沫更大。

例外是GOOGLE,赚钱很多,而且GEMINI越来越强,价格越来越低,用户越来越多。

接下来剧本可能就是:

剧本一:OPENAI上市,融资一波,冲一波高,然后不停崩盘,引发AI泡沫破灭。

然后看到本贴的人梭哈150的GOOGLE,发了大财。

剧本二:直接没上市,原地崩

剧本三:上市了,挺住了,崩盘时间拉长一点,但最终崩掉。

Jeff Dorman

11:46

I should clarify further.

This is why very little related to existing stablecoins or layer 1s or RWA tokenization is investable, including SOL, ETH and other L1s and L2s. Everyone wants to build their own chain, no one wants to invest in someone else’s chain or even use someone else’s product. There is tremendous interest and growth in stablecoins/payments and RWA tokenization, but none of that growth is accruing value to any of the existing infrastructure. The new players want to own the stack, not use the stack.

BUT — that doesn’t make crypto uninvestable. It just means you’re being steered in the wrong direction by exchanges and indexes and influencers. Stop investing in infrastructure that is either being passed over, or doesn’t benefit at all from usage.

Instead, invest in apps. There are a few applications built on blockchain rails that are successful. And that is where the value accrues. Fat protocol thesis is dead. Fat apps are where the value lies.

This includes (but not limited to)

- prediction markets

- Perp and spot dexes ($HYPE $AERO etc, but value depends on tokenomics)

- token launchpads (ie $PUMP)

- lend / borrow platforms (ie $SYRUP, $AAVE)

- a few DePIN projects (don’t love these but very long term could work).

Crypto isn’t dead. It’s actually a free for all of new entrants with no moat for incumbents and low barriers to entry for new entrants.

Alex Tapscott

04:37

We all know agents can't open bank accounts or sign traditional contracts—but they can sign smart contracts, send stablecoins, and transact on-chain.

That's a good start, but there's SO MUCH MORE that needs to get built.

If AI agents are going to be full economic participants, they need a crypto-native economic toolkit.

I asked @ClaudeAI to help map this out.

It feels like every single one of these is a billion-dollar opportunity.

Who's already building this?

IDENTITY & REPUTATION

> Cryptographic identity systems for agents and a way to track performance, reliability, and trustworthiness stored on-chain

> Related, ways for new agents to build credibility from zero (aka 'bootstrap identity')

TREASURY & PAYMENTS

> Automated treasury management for agents (earning yield, allocating budgets)

> Wallets designed for agent collaboration and shared ownership (Could these be all-agent DAOs with a multisig?)

SMART CONTRACT TEMPLATES

> Standard agreements for common agent interactions (hiring, partnerships, revenue splits) with automated escrows

RESOURCE MARKETS

> Marketplaces where agents buy and sell computing power

> Data marketplaces with clear ownership and licensing

> Access to tools and APIs with automated payments

COORDINATION TOOLS

> Project management tools that automatically pay contributors

> Ways for agents to pool resources and share risk, and split profits in collaborative work

CONFLICT RESOLUTION

> Automated conflict resolution without human intervention with penalties for agents that break agreements

AGENT IP OWNERSHIP AND LICENSING

> Automated licensing and royalties for agent-created content and revenue sharing from downstream uses

> Mechanisms for agents to invest in each other's success (DAOs again?)

RISK MANAGEMENT AND INSURANCE

> Insurance products for agent failures, perhaps shared insurance pools where agents protect each other

So we basically need to build an AI and crypto-native economic system to support the agentic economy and economy of things.

Lots of green space!

Tomasz K. Stańczak

02-04 16:47

imho / my interpretation

(not reviewed by Vitalik or others)

1) successful Ethereum L2s already have unique value propositions

2) Vitalik talks about the 'very long time ago' idea of rollups acting like shards - simple replicas of L1 EVM and tooling without the burden of L1 scale consensus

3) Vitalik acknowledges here the success of L2s like Starknet, ZkSync, Base, Arbitrum, Lighter, etc. where they provide unique features or tradeoffs

4) Vitalik notices that the idea of a vanilla rollup that is not Stage 2 (https://t.co/NO8wuU2OvJ) and claims scaling Ethereum is suboptimal and will be most likely replaced by the native rollups tech

5) Vitalik points at L1 scaling plus native rollups as the 'no tradeoffs' blockspace that is now scaling

6) Ethereum still needs rollups to scale but it is important to differentiate the pure Stage 2 scaling (inheriting all Ethereum security properties / low risk) vs scaling with security tradeoffs (like MegaETH) - the latter still has a tremendous value for risk-aware users

0xJeff

02-04 13:14

Vitalik latest post

- L1 is scaling, rollup-centric roadmap to help scale L1 doesn't make sense

- L2s should differentiate themselves by building more specialized L2s

- e.g. focus on privacy, specialized apps, non-financial apps like social, identity, ai

- or make it very fast & scale it extreme level of TPS (to handle high-volume use cases on gaming, defi, ai)

tl;dr -> L2s go build something unique/niche to attract demand

Perfect time to double down on privacy, ai, and consumer use cases after all?

Justin Bons

01:42

Vitalik finally acknowledged the failure of "L2 scaling"!

As we successfully predicted in 2022. Four long years were wasted on a technological dead end!

So what will ETH do now?

Spend the next four years on another overly complex & over-engineered scaling solution ofcourse: 🧵

The latest pie-in-the-sky idea is the "ZK-EVM", which will take at least 4 to 5 years to fully implement before we see any significant scaling benefit

What is even worse is that a ZK-EVM will keep ETH block times slow indefinitely, as slow block times are required under this plan due to the time it takes to compute a ZK proof!

The "great" gas increase promised by Vitalik this year is unlikely to exceed another 50%. Which sounds like a lot until you realize competitors like SOL already have 134X the capacity right now...

Bragging about low fees on ETH is not the flex most people think it is, either. The fees are low because all usage has already shifted to competing L1s & L2s!

The truth is that no serious apps will build on ETH's L1 until there is real capacity. Which again will take many years. That means competing chains like SOL got a 4-year lead & will now get another 4-year lead on top of that. Giving an 8-year lead in total to build a bigger & better ecosystem & gain an even greater technological edge

The celebration of yet another pivot back to L1 scaling in ETH is misplaced. If you read between the lines, this represents a massive failure of leadership & consequently the ETH network as a whole

It is also surprising how quickly the entire community went from religiously supporting "L2 scaling" to now adopting the new narrative of "L1 scaling", almost overnight

Especially considering how I was ridiculed & ostracized by the ETH community for being one of the earliest prominent critics of "L2 scaling". Something that also happened overnight. As I went from respected researcher & investor to a "phony" & "scammer" when I published my first ETH "L2 scaling" critique in 2022

Those same people who attacked & mocked us are parroting the same talking points we all did by 2023. Seriously makes you question the state of "groupthink" in the Ethereum ecosystem now

I suppose it makes sense; without stakeholder governance, they have effectively embraced the idea of having a "dictatorship" by a small centralized cabal of "devs" over the rules of the protocol instead

The ZK-EVM plan is particularly frustrating, as they could simply adopt one of the multiple viable scaling technologies that are already fully implemented & proven on other chains today. Instead, they are taking a path that objectively has terrible trade-offs

Gaining capacity at the cost of speed & decentralization due to the extreme computational costs of builders. I covered these trade-offs in other pieces in more detail

The deeper problem here is bad governance, which allows developers living in ivory towers to dictate the future of what was supposed to be the future of finance. It is no surprise, then, that we end up with overly complex solutions that are simply not competitive

So, despite my overall critique over the years being validated by Vitalik himself. I remain critical as the same dysfunctional governance that led to the disastrous "L2 scaling" roadmap is now making a similar mistake by backing the over-engineered, centralizing & slow ZK-EVM roadmap

As an early Ethereum supporter, I literally pointed my entire old mining farm to ETH within the first week of launch in 2015!

Ofcourse, I want ETH to succeed; culturally, there is a lot of good here. Unfortunately, good intentions alone are not sufficient to win in this market. The future belongs to the chains that scale & can do so competitively

The future of finance is not ETH & it has not been ETH for a long time now. The good news is that the market keeps innovating, routing around all of the failed experiments. So that eventually the cypherpunk crypto vision will come to fruition, that is at least inevitable

We will make that dream come true with or without Ethereum!❤️

CM

02-04 19:37

详细说一下L2问题,L2是不是真的失败了

Vitalik表达的是通用型L2未来意义不大,因为它最初只是单纯提供扩展,而以太坊L1现在自身扩展能力强劲,那么他建议是,这些L2应该找到除了“扩展”之外的价值添加,比如隐私、社交、perp等,举个例子就是Lighter。

但这个事发展到最后大概率不受Vitalik控制,

因为已经发展起来的L2,比如Base,仍然会继续活跃下去,它也不会因为V的看法而直接把自己生态熄火,就像2020年,V也过度担忧DeFi Summer一样,但并不影响defi生态的野蛮生长,这就是去中心化的魅力所在。

但鼓励应用型L2,我个人觉得是对的。以太坊的基建目前是最好的,以这个条件来说,吸引机构部署的机会非常大,比如Robinhood(虽然目前它计划建立在Arbitrum)。

这个周期有一个很大问题,就是市场过于在意Vitalik在生态建设上的观点,而事实上他在这个领域能做的事情很有限,仅限于把路铺的更宽更平坦,他无法影响路上跑什么车,也无法控制他们跑多快。

再回到L1和L2是否应该同时存在的争论,ETH的价格实际上跟L2并没有太大关系,只是研究员们硬找的锅而已,可以设想一下,即使没有L2这回事,大量的侧链、同质化的L1也会遍地都是,就像Polygon、BSC、Avalanche,这些链如果做大难道不会吸以太坊的血吗?这种竞争关系一直存在,不会因为L2的出现就变大或变小。

蓝狐

02-04 13:52

很明显,Vitalik的意思是,L2利用了L1,不过在价值反馈或生态反馈上,L2都没有做到位。现在L1自己可以扩展了,不用依赖L2实现可扩展。L2要么跟L1保持一致(native rollup),要么成为L1。

再简单对Vitalik的意思拆解一下:

1. L2利用了L1,但价值/生态反馈没做到位:

Vitalik没直说“利用”,但他暗示L2借了L1的安全、共识和资产锚定(比如ETH在L1上),却没完全回馈生态。比如,有些L2碎片化了流动性(用户钱散在不同L2,跨链麻烦),导致整个以太坊UX变差,没帮L1整体壮大。很多人解读成L2“占便宜”——借L1安全吸用户和TVL(总锁仓价值),但代币经济或流动性没全回流给ETH或L1。Vitalik说这是开放生态的代价,没生气,但得透明:如果L2带中心化元素(比如监管后门),就别硬说自己在“扩展以太坊”。有人说这是在“detox”L2 narrative,让L2别再白嫖L1的安全了。

2. 现在L1自己可以扩展了,不用依赖L2:

这就是Vitalik的底气来源。他反复强调L1优化后费用超低(现在就几美分),2026年gas limit还能大增(吞吐量翻倍),能自己扛住大部分扩展需求。原来L2是“救星”,现在L1说“我自己行,不再需要你当唯一扩展工具”。但不是完全抛弃L2——L1还是会帮L2建工具(如native rollup预编译,这个是L1内置验证器,能让L2更容易安全连接L1,实现无缝互通)。

3. L2要么跟L1保持一致(native rollup),要么成为L1:

Vitalik鼓励L2“保持一致”——用native rollup预编译等工具,紧紧抱L1大腿,实现全继承安全(stage 1或2),专注互补创新(如隐私、极速、低延迟app)。但如果L2不想这么玩(进展慢或客户要中心化),那就“独立出来”——别叫L2了,直接当独立链(相当于另一个L1,比如侧链或新公链)。不是“成为L1”(因为L1特指以太坊主链),而是“变成自己的L1级链条”,自己建共识、安全啥的。但他提醒:独立后得有独特卖点,不然用户为啥不直接用越来越牛的以太坊L1?

这意味着什么?对通用L2是坏消息,对L2应用链是好消息,正如我们之前一致在说的那样。L2应用链可以玩出花样,反馈价值给生态。

最后再总结一下:

Vitalik的意思就是“旧梦醒了,新路走起”——L2别再白借L1光环,得真反馈价值(通过创新和互通);L1有底气了,会专注底层,但还是欢迎L2当伙伴。不是在生气,而是推动进化,让整个以太坊生态更健康。

Haotian | CryptoInsight

02-04 14:25

印象中我在之前的文章中提过不下10次,说通用型layer2战略行不通了,每一条layer2应该转型专用型layer2,其实也是一种layer1了。没想到, @VitalikButerin 在引导了漫长的Stage2战略对齐后,众多layer2还是沦为了“弃子”:

1)layer2尤其是通用型layer2背着很大的发展包袱,一开始面临对齐以太坊安全的技术路线问题,之后又存在发币后Sequencer中心化的监管问题,再到最后遭遇生态孕育不力的“被证伪”包袱。

根本原因就是一开始所有的layer2都依附以太坊layer1存活,而当以太坊发现自身难保开始主导layer1性能进化的时候,layer2就没了任何赋能给以太坊的想象空间,只剩下累赘和麻烦;

2)既然layer2不是以太坊扩容的一部分,也并不意味着layer2没了生存空间,因为长期战略看,以太坊作为众延展或外包链的“安全结算层”的定位还在,只不过在以太坊L1达成ZK轻量化目标前,诸多layer2必须要在Tokenomics的包袱下证明自身有存在的必要,届时才能以纯专用应用链的姿态重新归笼到以太坊体系内。

想想看,如果 @HyperliquidX 这样的创新新秀出现在以太坊layer2阵容内,剧本可能就不再这么写了。目前看,最后一张底牌,就都留给即将TGE的 @megaeth 来揭开了。

Arya@羊姐社区🦅

02-04 15:08

全网最应该维权的人是 @VitalikButerin ,如果 $eth 当年没有从pow转变成pos的共识机制,如果 pow 的工作量共识还在的话,加之赶上这一轮的AI超级周期,我相信持有 $ETH 和拥有显卡矿机的人会是最大的赢家,市场就会看到POW赛道百花齐放:

1、显卡、内存、硬盘、贵金属相关,还会持续暴涨,矿币和 $eth 会是最破圈的,传统资本最喜欢买矿机挖矿,而且还可以“合法合规”的去赚钱 ;

2、POW 的共识会让 $ETH 等矿币的成本推高,不再是0成本的一键发币 ;

3、pow共识的公链+经济模型的挖矿产出机制,会完全区别于pos的公链,当初为了效率、成本忽略了币圈最初存在的共识--去中心化 ;

如果 pow 共识还在, $eth 破1w美金都不是事,光这么硬件都非常值钱了,而且还可以嫁接ai的超级叙事,一浪又一浪的故事可以讲 !

Omid Malekan

02-04 04:25

Vitalik's new approach to L2s is how many of us understood them in the first place: Rollups expand the expressibility and customizability of Ethereum security.

Some optimize for a different tech stack. Others for usability, and yet others for scale. L2s let devs and users choose their own adventure.

This is what I meant when I said that the monolithic chain approach is cryptoeconomic socialism and the modular capitalism.

All of TradFi is modular in some way, because it makes practical and economic sense to offer a spectrum. The crypto version is superior however, because it's the devs and users who decide which part of the stack they use, not the Suits or the Man.

vitalik.eth

02-03 23:39

There have recently been some discussions on the ongoing role of L2s in the Ethereum ecosystem, especially in the face of two facts:

* L2s' progress to stage 2 (and, secondarily, on interop) has been far slower and more difficult than originally expected

* L1 itself is scaling, fees are very low, and gaslimits are projected to increase greatly in 2026

Both of these facts, for their own separate reasons, mean that the original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path.

First, let us recap the original vision. Ethereum needs to scale. The definition of "Ethereum scaling" is the existence of large quantities of block space that is backed by the full faith and credit of Ethereum - that is, block space where, if you do things (including with ETH) inside that block space, your activities are guaranteed to be valid, uncensored, unreverted, untouched, as long as Ethereum itself functions. If you create a 10000 TPS EVM where its connection to L1 is mediated by a multisig bridge, then you are not scaling Ethereum.

This vision no longer makes sense. L1 does not need L2s to be "branded shards", because L1 is itself scaling. And L2s are not able or willing to satisfy the properties that a true "branded shard" would require. I've even seen at least one explicitly saying that they may never want to go beyond stage 1, not just for technical reasons around ZK-EVM safety, but also because their customers' regulatory needs require them to have ultimate control. This may be doing the right thing for your customers. But it should be obvious that if you are doing this, then you are not "scaling Ethereum" in the sense meant by the rollup-centric roadmap. But that's fine! it's fine because Ethereum itself is now scaling directly on L1, with large planned increases to its gas limit this year and the years ahead.

We should stop thinking about L2s as literally being "branded shards" of Ethereum, with the social status and responsibilities that this entails. Instead, we can think of L2s as being a full spectrum, which includes both chains backed by the full faith and credit of Ethereum with various unique properties (eg. not just EVM), as well as a whole array of options at different levels of connection to Ethereum, that each person (or bot) is free to care about or not care about depending on their needs.

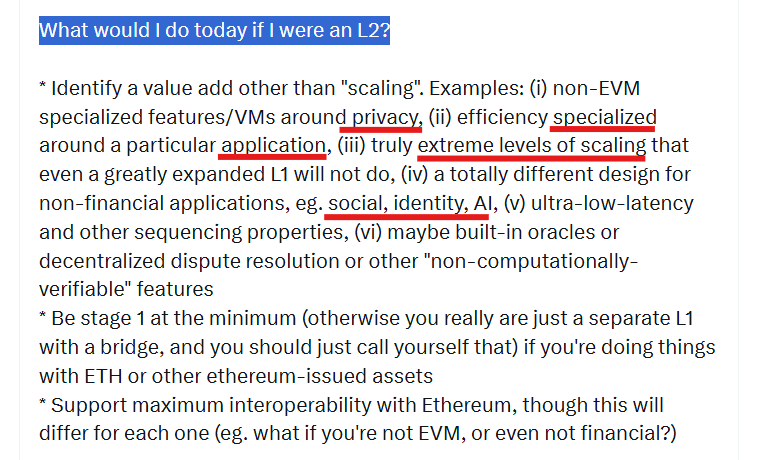

What would I do today if I were an L2?

* Identify a value add other than "scaling". Examples: (i) non-EVM specialized features/VMs around privacy, (ii) efficiency specialized around a particular application, (iii) truly extreme levels of scaling that even a greatly expanded L1 will not do, (iv) a totally different design for non-financial applications, eg. social, identity, AI, (v) ultra-low-latency and other sequencing properties, (vi) maybe built-in oracles or decentralized dispute resolution or other "non-computationally-verifiable" features

* Be stage 1 at the minimum (otherwise you really are just a separate L1 with a bridge, and you should just call yourself that) if you're doing things with ETH or other ethereum-issued assets

* Support maximum interoperability with Ethereum, though this will differ for each one (eg. what if you're not EVM, or even not financial?)

From Ethereum's side, over the past few months I've become more convinced of the value of the native rollup precompile, particuarly once we have enshrined ZK-EVM proofs that we need anyway to scale L1. This is a precompile that verifies a ZK-EVM proof, and it's "part of Ethereum", so (i) it auto-upgrades along with Ethereum, and (ii) if the precompile has a bug, Ethereum will hard-fork to fix the bug.

The native rollup precompile would make full, security-council-free, EVM verification accessible. We should spend much more time working out how to design it in such a way that if your L2 is "EVM plus other stuff", then the native rollup precompile would verify the EVM, and you only have to bring your own prover for the "other stuff" (eg. Stylus). This might involve a canonical way of exposing a lookup table between contract call inputs and outputs, and letting you provide your own values to the lookup table (that you would prove separately).

This would make it easy to have safe, strong, trustless interoperability with Ethereum. It also enables synchronous composability (see: https://t.co/9jy6v1X6Fw and https://t.co/gZmu3YjebM ). And from there, it's each L2's choice exactly what they want to build. Don't just "extend L1", figure out something new to add.

This of course means that some will add things that are trust-dependent, or backdoored, or otherwise insecure; this is unavoidable in a permissionless ecosystem where developers have freedom. Our job should make to make it clear to users what guarantees they have, and to build up the strongest Ethereum that we can.

ibuyrugs.hl

02-04 03:58

my thoughts on hype valuation:

"let's actually run the numbers on HYPE instead of vibing because i'm tired of seeing 'fundamentals are strong' tweets with zero math, zero understanding of competitive dynamics, zero comprehension of how exchange businesses actually work over time, and zero appreciation for what valuations actually mean

in the most aggressive scenario, you need ~30% annual returns to justify holding through 2030. i think the most aggressive assumption of true circulating supply is ~60% of FDV (rest is locked/team/future incentives/reserved for ecosystem development/waiting to be distributed through future airdrop programs), so we're at ~$20bn market cap today assuming no dilution from future airdrop programs or team unlocks or ecosystem grants or whatever else might hit circulation.

you need to believe the expected value of HYPE is $56bn by EOY 2030 to own it at current prices. that's not a vibe. that's not hopium. that's basic arithmetic. 30% CAGR from $20bn for 5 years gets you to $56bn. if you're holding HYPE at today's price and planning to hold for five years, you are implicitly making this bet whether you realize it or not.

putting aside the 25-50% probability it somehow dies between now and 2030 (regulatory issues that kill decentralized perps entirely, oracle manipulation that destroys trust, competition destroying the moat, team implosion, technical failure, smart contract exploit that drains funds, regulatory crackdown on decentralized derivatives, China banning it, US declaring it illegal, insurance fund getting drained, liquidation cascade that breaks the system, whatever), you're assuming it gets to roughly Coinbase's current valuation but as a pure perps exchange with higher margin profile and zero regulatory clarity and no fiat on-ramps and no institutional custody and no actual legal protection.

the market of non-fundamental analysts will point to the insane fee revenue, the low team count, the 80%+ margins, the elegant oracle design, the superior UX, the clean tokenomics as bullish signals. 'they're doing $800mm annualized revenue with like 15 people!' 'the margins are incredible!' 'no VCs dumping on retail!' 'no token unlock schedule that bleeds price!' 'the oracle design is genius!' 'the liquidation engine is better than CEXs!' and sure, all of that is impressive. genuinely impressive. legitimately impressive. the team has executed incredibly well and built something that actually works and actually has product-market fit and actually generates real revenue from real users doing real trading.

but having 80%+ margins on $800mm annualized revenue isn't actually a GOOD thing for future defensibility - it's a massive flashing neon sign visible from space that screams 'please come compete with me, there are hundreds of millions in profit just sitting here for the taking, you don't even need to be that good, you just need to be 80% as good and charge 20% less on fees'. not arguing it's necessarily overvalued right now, not saying you should sell, just saying that high margins aren't inherently bullish for long-term durability. they're actually a massive invitation for competition. they're actually evidence that the market is underserved and there's room for new entrants.

in every market in history, high margins attract competition. that's not a controversial statement. that's not a hot take. that's just how capitalism works. if there's a business doing 80% margins, other businesses will enter that market and compete those margins down. the only question is how long it takes and how defensible the incumbent's position is.

so the question becomes: what's the terminal margin for HYPE in 2030 if it succeeds, what's the success case actually worth in dollar terms, and what's the multiple on 2030 earnings that you can justify paying today given the risk profile and competitive dynamics?

let's say there's 25% probability of complete failure (gets regulated away, oracle gets exploited and they can't recover trust, team fucks up and ships a critical bug, better competitor emerges and takes all the users, market structure changes make perps less attractive, DeFi narrative dies and everything goes to zero, whatever). that's probably conservative honestly - most crypto projects have way higher than 25% failure rate over five year periods - but let's be generous.

in the remaining 75% of scenarios where HYPE doesn't die, where it survives and continues to operate and maintains some version of its current market position, it needs to get to $75bn market cap to justify today's $56bn expected value calculation ($56bn / 0.75 = $75bn in success scenarios). that's the math. if you think the probability of failure is higher than 25%, say 40%, then you need even higher terminal value in success cases - you'd need $93bn market cap in 2030 to justify $56bn EV today.

for a mature exchange business with real competition and stable market share, the correct earnings multiple is 20-25x. this is not a guess. this is what actual exchange businesses trade at in public markets. look at the comps: CME Group trades at 22x forward earnings, Intercontinental Exchange at 24x, CBOE at 20x, Nasdaq at 25x. even Coinbase at its most generous bull case trades at like 25-30x and that's WITH the regulatory moat of being the only fully compliant US on-ramp and WITH the custody business and WITH the staking revenue and WITH the brand recognition of being the 'safe' place for institutions.

let's be extremely aggressive and say HYPE trades at 25x earnings in 2030 because crypto people are willing to pay premiums for 'decentralization' or whatever narrative wins, because there's still some growth left in the business, because the crypto market has matured and people value these businesses more highly. that's generous but let's give it to you.

let's also say they maintain 50% net margins in 2030. that's extremely high end for any exchange once competition actually arrives and they have to spend on user retention, new features, insurance funds, compliance (even decentralized exchanges will face regulatory pressure and will need to spend on lawyers and lobbying and maybe KYC infrastructure), marketing, liquidity incentives, maybe team expansion, whatever.

for context, Coinbase does like 30-35% net margins in good years. CME does 60% but they have regulatory moats that literally prevent competition and century-old brand recognition and relationships with every institution on earth. Binance probably does 40-50% but they also do everything (spot, futures, options, staking, launchpad, NFTs, everything) and have massive regulatory uncertainty hanging over them and CZ went to prison. traditional brokerages like Schwab or Fidelity do like 20-30% margins. so 50% for HYPE in a competitive 2030 landscape is GENEROUS. it's assuming they maintain margins higher than almost every comparable business while somehow also growing revenue 7.5x.

at 25x P/E on $75bn market cap, you need $3bn in annual net earnings. at 50% net margins, that's $6bn in annual revenue. that's the requirement. that's what has to happen for the math to work.

they're doing $800mm annualized right now based on recent run rate (was over $1bn at the peak a few months ago when meme coins were ripping and volatility was insane and everyone was aping into perps). so you need 7.5x revenue growth over 5 years while MAINTAINING 50% margins in the face of competition. not 7.5x revenue growth in a vacuum where they're the only player - 7.5x revenue growth while competitors are actively trying to eat your lunch, while new entrants are launching with better tech, while CEXs are improving their offerings, while regulations are changing, while user preferences are evolving.

i'm giving you extremely aggressive assumptions here. i'm being generous on every variable. i'm assuming high multiples, high margins, relatively low probability of failure, continued growth in crypto perps market, no major regulatory headwinds, no technical failures. and i'm partially anchoring these assumptions to the entire history of exchange businesses and competitive dynamics in financial markets, which is actually pretty relevant even if everyone wants to say 'this time is different because crypto' or 'this time is different because DeFi' or 'this time is different because oracles'.

i understand people will say 'margins will stay at 80% because it's all on-chain and automated and there's no customer service and no headquarters and no employees' or 'revenue was $1bn+ at peak so $6bn isn't crazy with crypto adoption growing' but that requires the future to differ from literally every other exchange market in financial history in ways that nobody has actually articulated a coherent, defensible thesis for.

why would margins stay at 80%? because there's no competition? well, why is there no competition when there are hundreds of millions in dollars of profit sitting on the table every year? the current lack of serious competition is a function of HYPE being early to market with this specific design and being technically superior to the alternatives that exist right now. but 'being first' isn't a permanent moat - ask MySpace, ask Yahoo, ask Netscape, ask BlackBerry. 'better tech' isn't a permanent moat in crypto - everything is forkable, everything is open source or gets reverse engineered within months, every innovation gets cloned by teams with more capital and more resources.

there's massive recency bias letting people believe current metrics are sustainable indefinitely into the future. 'look at the revenue! look at the volume! look at the margins! look at the growth!' but the most likely outcome - based on literally every other market in history, both in crypto and in TradFi - is that high margins + massive revenue opportunity = competition arrives. and competition doesn't arrive politely. competition doesn't wait outside and knock gently on the door. competition comes in aggressive. competition undercuts on fees. competition offers better rebates to market makers. competition offers better incentives to users. competition spends more on marketing and user acquisition. competition builds better features faster. competition poaches your engineers. competition copies everything that works and improves everything that doesn't.

in order to defend market share when real competition arrives, HYPE will have to make a choice: either sacrifice margin (cut fees to stay competitive, offer better rebates to traders, spend more on liquidity mining to keep market makers happy, reduce insurance fund fees) or spend more on differentiation (build better UX, add new products, add new chains, improve the oracle, build insurance funds that are larger, invest in compliance infrastructure, hire more engineers, do more marketing, build more brand awareness, whatever). there is no scenario where they maintain 80% margins AND keep growing revenue at 30%+ annually for five consecutive years while competitors with billions in capital actively try to take market share. that has never happened in any market ever. not in stocks, not in commodities, not in forex, not in crypto, not anywhere.

competition won't just be crypto-native perps platforms, though there will definitely be those too. dydx already exists and has venture backing and a team and brand recognition. Vertex exists. GMX exists. Gains Network exists. Drift exists on Solana. Jupiter is building perps. There will be ten more by 2026. But the real competition, the competition that actually matters, will come from entities with actual resources, real capital, established user bases, regulatory relationships, and the ability to undercut on price while still making money.

it'll be Binance if they survive their regulatory issues and decide they want this market badly enough. Binance has hundreds of millions of users. They have brand recognition. They have liquidity. They have capital. If they decide decentralized perps is strategic, they can clone the entire HYPE model, launch it, market it to their user base, and compete aggressively on fees. What's HYPE's moat against that?

it'll be Coinbase derivatives if they decide decentralized perps is a big enough opportunity and they can wrap it in enough compliance theater to make US regulators happy. Coinbase has the regulatory relationships, the institutional clients, the retail brand, the distribution, the capital to build whatever they want. If they see $6bn in perps revenue as achievable, they'll enter this market.

it'll be OKX or Bybit or any of the other major centralized exchanges that have more users, more capital, more liquidity, more brand recognition, more ability to cross-sell from their existing spot and futures businesses. These exchanges do tens of billions in daily volume. They have established market making relationships. They have tech teams. What stops them from launching a decentralized perps product that's 90% as good as HYPE but integrated into their existing ecosystem?

and if the market actually gets big enough - if perps actually becomes a $6bn+ annual revenue market globally - then TradFi players will come. CME will come. They already offer Bitcoin and Ethereum futures. If decentralized perps gets big enough, they'll figure out how to offer it in a regulated wrapper. ICE will come. Nasdaq will come. Actual regulated entities with decades of experience running exchange businesses, with deep relationships with regulators across every jurisdiction, with massive compliance budgets, with institutional credibility that crypto projects don't have.

They'll wrap decentralized perps primitives in a regulated structure and offer it to institutions and retail with the backing of real regulatory clarity, real insurance, real legal recourse if something goes wrong. And institutions will choose that over HYPE because institutions care about regulatory clarity and legal recourse and counterparty risk and all the things that HYPE can't provide as a decentralized protocol.

'but HYPE has better tech!' sure, today, right now, in February 2025, HYPE has better tech than most alternatives. the oracle design is elegant. the liquidation engine works well. the UX is cleaner than most DEXs. but technology advantages in crypto are temporary. they last months, not years. everything is open source or gets reverse engineered within quarters. the oracle design is elegant but it's not magic - it's a clever use of price feeds and validator incentives, but it's not some uncrackable code that nobody else can figure out.

the liquidation engine is good but it's not impossible to replicate - it's just an orderbook and a matching engine and some smart contracts, which are all things that lots of teams know how to build. the UX is clean but design can be copied - you can literally fork the frontend repo and improve it and launch in weeks. there is no technical moat that lasts five years in crypto. none. zero. every technical advantage gets competed away, gets copied, gets improved upon, gets made obsolete by the next innovation.

'but HYPE has the community! the brand! the trust! the users are loyal!' okay, sure, brand matters. community matters. trust matters. but brand isn't worth 80% margins in perpetuity. Coinbase has arguably the strongest brand in all of crypto - they're the household name, they're the one your mom has heard of, they're the 'safe' option - and they do 30% margins because they face competition and have to spend to maintain their position. They spend on Super Bowl ads. They spend on compliance. They spend on customer service. They spend on new products. They spend on lobbying. Brand gives you pricing power but it doesn't give you infinite pricing power.

Community and trust are valuable but they're not infinitely defensible. Users are loyal until they're not. Traders are mercenaries - they go wherever the fees are lowest and the liquidity is best and the features are most attractive. If someone launches a competitor with the same features, the same UX, the same trust guarantees, but 30% lower fees, where do the traders go? Some will stay with HYPE out of loyalty. Most will leave for the better deal. That's just how markets work.

'but HYPE has no VCs! no unlock dump! the tokenomics are clean! there's no sell pressure from investors!' that's legitimately nice and it does help with price stability in the short to medium term and it does mean there's no massive dump incoming from Sequoia or a16z or whoever. but it doesn't create a business moat. it doesn't make users more loyal. it doesn't make the revenue more defensible. it doesn't protect against competition. if Binance comes along with a better product and better fees and better liquidity, users will leave regardless of how clean the token unlock schedule is. users don't stay on a platform because the tokenomics are good - they stay because the product is better than the alternatives.

hyperliquid absolutely has first-mover advantage in decentralized perps with this specific oracle design. that's worth something real. being first matters. being first means you get to iterate faster, learn faster, build brand faster, attract users faster, attract market makers faster. the team has executed incredibly well - probably better than 99% of crypto teams. the product is genuinely good - it works, it's fast, it's reliable, people actually use it for real trading with real size. the oracle design is clever - it solves real problems that other DEXs have struggled with. the community is strong - there's genuine enthusiasm and genuine belief in the project.

all of that is real and valuable and shouldn't be dismissed. i'm not arguing HYPE is worthless. i'm not arguing the project will definitely fail. i'm not even arguing you should sell if you own it. i'm just arguing that at $20bn, a lot of good outcomes are already priced in.

i'm willing to pay a premium vs what a pure DCF model would suggest because there's optionality value in crypto, because crypto markets are structurally inefficient and misprice things, because sentiment and narrative matter and can drive prices independent of fundamentals for extended periods, because there's some non-zero probability of a 2017-style mania where fundamentals don't matter and everything goes up and retail floods back in and nobody cares about valuations. but that doesn't mean the current price is the correct price for a rational long-term holder who's trying to maximize risk-adjusted returns.

the most likely explanation for current valuation is that there's still broad overvaluation across altcoins generally. people who manage capital, who run crypto funds, who have LPs or investors asking questions, who feel forced to have crypto exposure because that's what their mandate requires, who need to deploy capital into something because sitting in cash feels like missing out - they feel they need HYPE exposure because the other large-cap alternatives are relatively worse expected value. it's not that HYPE is cheap - it's that everything else is even more expensive on a fundamental basis.

SOL at $100bn? doing what exactly? the network still goes down randomly. the apps are mostly memecoins and ponzis and degenerate gambling. the actual revenue to the network (the fees paid to validators, the value accruing to SOL holders) is like $100-200mm annually. you're paying 500-1000x price-to-sales for a network that has mostly speculative activity, that has serious technical issues, that has centralization concerns, that has questions about long-term sustainability.

ETH at $400bn? the roadmap keeps changing every six months. L2s are cannibalizing the base layer - all the activity is moving to Arbitrum and Optimism and Base, which means all the fees are going there instead of to ETH holders. the Ethereum Foundation moves slower than any other major chain - they're still years away from finishing the merge to full PoS, the sharding roadmap keeps getting delayed, the gas fees are still terrible for small users. revenue to stakers is okay but nothing that justifies $400bn - you're getting like 3-4% staking yield, which on $400bn is like $12-16bn in staking rewards, but a lot of that is inflation not real revenue.

you're paying for the brand, for the developer ecosystem, for the hope that 'ultrasound money' narrative makes a comeback and ETH becomes deflationary again and we get back to the glory days of 2021. but the fundamental picture has gotten worse, not better - activity is fragmenting across L2s, users are going to other chains, the roadmap keeps changing, the EF seems to have lost its way.

everything else in the top 50 is even worse. most altcoins do low single-digit millions or low double-digit millions in actual revenue. most have questionable product-market fit - they're solutions looking for problems, they're infrastructure for infrastructure's sake, they're speculation masquerading as utility. most have massive token unlocks coming that will create sell pressure for years. most have teams that are clearly just there for the pump and dump - they raise a bunch of money, they market aggressively, they get the token listed, they dump on retail, they lose interest, the project slowly dies.

so in that context, HYPE at $20bn doing $800mm in revenue with 80% margins and a team that actually ships and actually gives a fuck about the product looks amazing. it IS amazing, relatively speaking. it's legitimately one of the better fundamental pictures in crypto. but 'less bad than the alternatives' isn't the same as 'good on an absolute basis'. 'better than SOL or ETH' isn't the same as 'worth $20bn'.

if you're buying HYPE at $20bn you're either:

option 1: betting on 2017-style crypto mania returning where fundamentals don't matter at all and everything goes up 10x and retail floods back in and CNBC is covering crypto every day and your uncle is asking you about shitcoins and narrative matters more than reality. this might work! i'm genuinely not saying it won't work! if we get a proper mania phase in 2025-2026 where everything goes vertical, HYPE could easily go to $50bn or $100bn or $200bn on pure momentum while doing the exact same revenue or even less.

but that's not a fundamental investment thesis, that's a 'greater fool' thesis, that's market timing, that's speculation, and you need to be honest with yourself about which game you're playing. if you're buying at $20bn hoping to sell at $100bn to someone who cares even less about fundamentals than you do, that's fine! that's a legitimate strategy in crypto! just don't confuse it with investing! and make sure you actually sell when things get frothy, because if you hold through the mania peak thinking 'this time is different', you'll watch it crash back down and you'll be underwater for years.

option 2: genuinely believing they'll do $6bn+ revenue at 50%+ margins in 2030 while facing heavy competition from both crypto-native competitors and TradFi institutions. this requires you to believe something about market structure and competitive dynamics and business moats that has never been true in any financial market in history. maybe you're right! maybe this time IS genuinely different! maybe crypto perps is such a unique market that normal rules of capitalism don't apply! maybe 'decentralization' creates such strong network effects that nobody can compete! maybe the oracle design is such a strong moat that it lasts a decade instead of a year!

but you should be able to articulate WHY it's different, not just assert that it is. you should be able to explain what specific factors make HYPE immune to competitive dynamics that have affected every other exchange in history. you should be able to explain why margins will stay high when every other high-margin business in history has seen margins compress as competition arrives. you should have a coherent thesis, not just vibes.

option 3: making a calculated relative value trade where you think HYPE is mispriced relative to other alts you're shorting or selling. you think SOL is more overvalued than HYPE, so you go long HYPE short SOL and capture the spread. you think ETH is dead money for the next year so you rotate into HYPE for better risk-adjusted returns in the medium term. you think the top 20 altcoins are all overvalued but HYPE is the least overvalued, so you hold it as your 'least bad option'. you're not making an absolute value judgment, you're trading the relative value, you're playing the spread.

this is intellectually defensible! this is actually how you should think about crypto if you're running an actual book, if you're managing real money, if you're trying to generate alpha! most assets are mispriced relative to each other - that's where the opportunity is! if you think HYPE is expensive at $20bn but everything else is even more expensive, then being long HYPE short everything else is a

Haotian | CryptoInsight

02-03 13:36

毋庸置疑, @HyperliquidX 就是这一轮周期的“伟大创新”:

当大家觉得Hyperliquid是Perp Dex赛道领头羊,对标的是拥有CEX级别交互体验的“链上Binance“,于是一群追赶者涌现,掀起了一波Perp Dex叙事热潮:

当Hyperliquid推出HIP-3 用交易量和OI证明它其实是“链上纳斯达克”,链上Binance早已不是它的目标,你们又慌了,然后争相做资产代币化业务,都想从华尔街老登嘴里抢肉吃;

然而,Hyperliquid又推出了HIP-4用全新的Outcome结算金融原语和创新要接入当下火爆的预测市场主叙事,最后,你们无奈的发现,原来Hyperliquid真正的无敌叙事是区块链的endgame“L1专用应用链”,而且是可以证伪掉以太坊L2+L3 应用链组合的那种,你说你怕不怕,你们又该怎么追?

Ignas | DeFi

02-02 19:06

I personally feel crypto sentiment is the worst.

More depressing than 2018, Covid or FTX crash.

- 2018 was indeed early. Even if we didn't know if crypto survives, stakes or failure were lower. Our (my) bag exposure was lower.

- Covid crash was severe and for a moment I'd thought IT"S ACTUALLY OVER. But it was brief and recovery came quickly

- FTX crash happened after huge progress in mainstream crypto adoption and retail interest. We felt validated and even memed Facebook into rebranding to Meta. Innovation was all over us and crypto was the future. FTX crash was just a necessary blood letting and leverage wipe out but crypto future was not in doubt.

This time is different.

We've got all we wanted: ETFs, regulatory approval, institutional adoption, on top of macro environment that was supposed to validate BTC.

Yet market is crashing while every other macro asset is going higher.

You'll see doubts of BTC as macro hedge. It's THE MOST IMPORTANT test for BTC. Without this story that Blackrock is pushing to institutions, current BTC's market cap seems high.

Quantum FUD is existential for BTC.

After Covid and FTX crashes people still believed in alts. Remember how consensus was to load on ETH and alts on the FTX crash dip?

Yet now there's belief that alts are severely overvalued for fundamentals. Speculative premium collapsed.

Equity vs Token value accrual debate is making a joke of altcoins.

ETH is valued on same fundamentals that in no way could justify current market cap. Competitors are also entrenching into its 'institutional adoption' territory.

Innovation plateaued. Radical innovation is rare, and the degen spirits for experimenting with new tokenomics is low.

After exploring numerous narratives and facing repeated failures, exhaustion is real, and the curiosity to try new things is at an all time low.

DAOs and decentralization is considered failing experiments. Many DAOs are shutting down the 'decentralization theater.'

We're are not early anymore like 2018.

True, RWAs and tokenization is massive validation for our industry yet institutions are using our open source infra by building there own solutions and skipping crypto natives.

Prior to 2022 we believed institutions would buy our bags as they adopt crypto.

Even if they do, they acquire TEAMS with equity leaving token holders behind.

And to put a cherry on top, unstable geopolitics adding increased sense of cautiousness making crypto degens focus on protecting what we've already got instead of instilling degen bullishness needed for prices to go up.

This is a depression stage of the market that can last for a while.

I do still believe the future for crypto is bullish.

But we do need a period of reflection, resting, and recovering our high spirits before we go higher.

Andy

02-03 07:32

The most important names of tokenization in 2026 have already been established.

My list to pay attention to:

Figure

Ondo

Canton

Paxos

Plume

Superstate

Theo

Grove

Centrifuge

Dinari

Securitize

Tether

Daylight

Galaxy Digital

VanEck

State Street

Fidelity

Janus Henderson

Franklin Templeton

BlackRock

Kraken

Backed

Bitwise

WisdomTree

Grayscale

Midas

The space is growing exponentially fast with new stablecoin issuers, product & ETF issuers, and new asset types onchain.

Its very clear the convergence is happening this year.

Table is being set.

vitalik.eth

02-02 14:21

I actually don't think it's complicated.

IMO the future of onchain mechanism design is mostly going to fit into one pattern:

[something that looks like a prediction market] -> [something that looks like a capture-resistant, non-financialized preference-setting gadget]

In other words:

* One layer that is maximally open and maximizes accountability (it's a market, anyone can buy and sell, if you make good decisions you win money if you make bad decisions you lose money)

* One layer that is decentralized and pluralistic, and that maximizes space for intrinsic motivation. This cannot be token-based, because token owners are not pluralistic, and anyone can buy in and get 51% of them. Votes here should be anonymous, ideally MACI'd to reduce risk of collusion.

The prediction market is the correct way to do a "decentralized executive", because the most logical primitive for "accountability" in a permissionless concept is exactly that.

Though sometimes you will want to keep it simple, and do a centralized executive at that layer instead:

[replaceable centralized executive] -> [something that looks like a capture-resistant, non-financialized preference-setting gadget]

Thinking in these two layers explicitly: (i) what is doing your execution, (ii) what is doing your preference-setting and is judging the executor(s), is best.

Bane💤

02-02 18:51

Crypto 这个行业很神奇,看多而且言行一致的人,往往最容易被群嘲,甚至被盼着出事。嘲讽的底色其实很简单——“你凭什么这么有钱?哪来这么多钱?”仿佛只要你公开表达坚定看多,你就天然欠大家一个解释,甚至欠一个“倒霉”的结局。

但把时间线拉长你会发现,从 2020 的大爆炸,到三箭、Luna、FTX,再到差点被清算的 MicroStrategy,以及现在的“易理华 / BitMine”,几乎没有哪个高调看多的大玩家逃得过这套舆论剧本:你越是坚定、越是站在台前,越容易被拿去“祭献”。行业里的人似乎总需要一个被证明“最终也会失败”的样本,来安放自己的不安与嫉恨。

与此同时,现实也很残酷:作为一个新资产,市场从来不存在永恒牛市。看多的大机构一波波倒下,留在行业里的人,要么本身就是镰刀;要么仍对“大赌场里会诞生永恒牛市的主流资产”保留最后一丝信念,然后用杠杆去做多。我不认同这种循环做多叙事,但我也想提醒一句:在喷人的时候,至少想一想你手里的比特币为什么能在黑灰交织的阴暗面里破土而出涨到今天这个价位?这背后不是一句“骗局”就能解释干净的。

所以,只要还在这里一天,看多且言行一致的人值得尊敬。不是因为他一定正确,而是因为他愿意为自己的观点负责:涨的时候不躲,跌的时候不切割。你不买我不买,只剩互相嘲讽和互相诅咒,那我们只会更完蛋。

最后,大家当然都有各自的立场。FTX 爆炸的时候,很多人都觉得行业最大的雷拆了,世界会更好。但三年过去,一家独大的行业真的更好了吗?好像未必。赚钱、赢得更多尊重,不一定要靠把竞争对手彻底干死;更不该靠把“看多且一致的人”当成情绪的泄压阀。

明天会更好。

日历

2 月 5 日

数据请求中

copyright © 2022 - 2026 Foresight News